Not surprisingly, many people fool around with PayPal to send money, making it a convenient option for currency transmits outside normal bank accounts. More often than not, this type of charges are $15 and are casinolead.ca you can try this out billed once a month up until a transaction is actually made. Just remember that , specific banking institutions and credit unions obtained’t charges inactivity costs, otherwise only charges them should your harmony are under a specific matter. At the same time, of numerous banking institutions tend to charges users to have making a checking account entirely inactive. For those who don’t done any deals with your family savings for a long time—typically 1 year—your own bank can charge your inactivity charges. Very, there is usually a limit out of half a dozen free distributions open to you within a given declaration months.

Misc Functions

Among the financial institutions one to undertake undocumented immigrants is Wells Fargo, PNC, You.S. Lender, BMO Harris, Alliant Credit Partnership, Lender of The united states, HSCB, and you may TD Financial. This may make sure he or she is well prepared in order to transition so you can a different country and take away the stress from taking care of funds inside an already tiring means of transferring to a different nation. You Bank accounts for Foreign Nationals will be an effective way to manage your own United states paying if you are overseas.

Bid farewell to defense deposits.

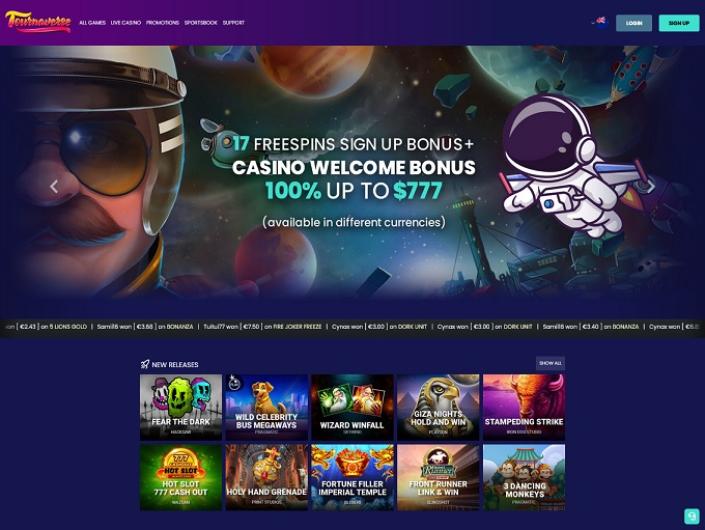

A no-deposit incentive ‘s the best approach in order to kickstart the online casino experience. Score a chance to victory a real income without the need to put just one cent! No deposit bonuses are perfect for tinkering with the new gambling enterprises instead of people monetary union. Just remember that , PayPal’s fees can often be high, and their exchange rates are usually greater than those employed by competition. The big disadvantage to correspondent financial is that it’s both slow and you may costly. Unlike domestic instantaneous currency transfers, the fresh Quick community needs time to work considering the connectivity sometimes expected to reach a different lender.

Yearly Commission Give (APY) are accurate as of XX/XX/XXXX, is at the mercy of changes with no warning, and will also be calculated and you will fixed to your name from the money. It’s an insurance policy in which the resident will pay a non-refundable fee every month (or superior), for as long as the brand new citizen features a rent. The fresh fee every month is founded on the newest citizen’s credit rating which is paid off straight to Rhino. Within the application procedure, you will observe a good checkbox to the Put Waiver solution.

Although not, beware you to definitely trade deal threats, and you will eliminate the investment. Usually, you will have to establish who you are, get your handbag set up, and sometimes you will have to take part in specific first change otherwise money your account which have at least deposit. According to the exchange’s rules, you may want to confirm your account. It verification techniques usually concerns getting character files to be sure protection and you will compliance having regulations.

Starting a bank checking account online is always limited by people merely, unless you’lso are using a worldwide or correspondent membership (come across less than). The newest Axos Financial Benefits Family savings offers a fantastic mix of features. Plus the bank provides unlimited reimbursements to have home-based out-of-circle Atm charge. All the services to the Tradersunion.com webpages is 100 percent free to work with.

To participate PenFed, you need to open a savings account and you may put no less than $5. You can’t availability the brand new checking account as opposed to an excellent PenFed savings account. The put alternative provider allows you to prevent missing rent and damage, market down disperse-inside the possibilities and reduce bad debt rather than losing apartments away from higher shelter dumps. This is why you ought to only invest money that you are prepared — otherwise are able to afford — to get rid of during the such as higher threats. Tradersunion.com will not give one economic characteristics, in addition to investment or monetary advisory functions.

New registered users is also allege a welcome provide pack well worth to 6,200 USDT because of the registering, making its earliest put, and you can finishing positions inside one week. At the same time, for every friend called, profiles is also earn an additional 200 USDT inside advantages. Every day view-inches and activity end render next chances to collect things, which is used to own trade bonuses and you will USDT. With daily and much time-name incentives, Bitget has profiles engaged and rewards active participation on the platform. The new HTX Interests Cardio offers a variety of professionals both for the new and current pages. People is also open individuals benefits by the finishing tasks including signing upwards, and make their basic put, otherwise change.

You’ll get access to Zelle to send and you can receives a commission, on the internet and mobile financial, and online statement spend has also. RFC Repaired Deposit provides NRIs who have gone back to India a great a good chance to secure high productivity to the fund they hold in the foreign currency. Even although you is also’t discover a good Us savings account, or if you have to take control of your money whilst you waiting to open you to definitely, there are still solutions for you. If you are an offshore membership is a wonderful alternative to a consistent Us bank account, it yes aren’t for all.

An average interest rate to own an interest-making savings account are 0.07% inside December 2024, with respect to the Federal Put Insurance coverage Corporation (FDIC). Several of the most preferred are monthly restoration charge, minimum equilibrium charge, overdraft charge and you may Atm charge. A good $15 month-to-month repair fee, for example, perform ask you for $180 a year. So it membership combines both examining and you will offers features, very based on your financial wants, this may do the job.

Remove shelter dangers

Consider using a virtual private circle (VPN) for added security when carrying out on the internet financial deals external your home network. Maintaining a non-resident bank account demands patient management and you may a hands-on approach to shelter. Productive administration decrease possible issues and you may ensures seamless usage of your money.

Anybody otherwise entity may have FDIC insurance coverage inside an enthusiastic covered financial. Men does not have to become a good U.S. resident otherwise citizen to possess their unique deposits insured because of the the new FDIC. If you’re also surviving in the united states but have yet to get resident condition, you might submit an application for a checking account individually. On the internet functions are often restricted to Americans and you can permanent residents simply. While the opening a vintage family savings will likely be tricky for low-people, you could seek out other options, including a good multiple-money membership, a global membership, and you will a great correspondent membership.

It’s along with ideal for people that don’t overdraft its membership have a tendency to. Axos offers twenty four/7 customer service via mobile phone and secure on line chatting. The website also has a real time chat ability available throughout the normal regular business hours. For the most careful, several classes and instructions offer a danger-totally free treatment for acquire crypto trade degree.